|

WHAT ARE THE COSTS INVOLVED IN BUYING A HONG KONG RESIDENTIAL PROPERTY?

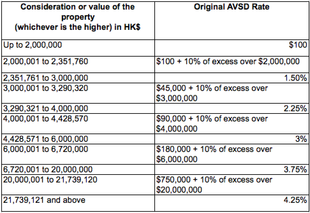

What Are The Deposits Required?Deposits for standard acquisition of Hong Kong residential property are: 1. Initial deposit (5%) to be paid upon the signing of the Provisional Sales and Purchase Agreement 2. Further deposit (5%) to be paid 2 weeks later 3. Balance of 90% to be paid 6 weeks later What Are The Standard Agency Fees?1% of sales price is the standard Hong Kong agency fee, payable by both a vendor and a purchaser. What Are The Current Stamp Duty Rates? The original stamp duty rates for purchasing residential property in Hong Kong are The following are NO LONGER applicable to purchasing property in Hong Kong (Effective 28th February 2024):

New Ad Valorem Stamp Duty (New AVSD) (Effective Date: 5th November 2016) Buyers Stamp Duty (BSD) (Effective Date: 27th October 2012) Special Stamp Duty (SSD) (Effective Date: 20th November 2010 & Updated 27th October 2012) |

|

What Are The Associated Legal Fees?Approximately 0.1% of the sales price for a standard acquisition of a Hong Kong residential property. What Are The Recurring Costs Involved? 1. Management Fees Management fees vary according to the number of units and the buildings facilities. In Scenic Villas they are currently set at HK$6,300 per month. Every building has an Incorporated Owners Committee (IOC). They are responsible for ensuring the maintenance and upkeep of the premises. One of their main roles is to appoint a management company to ensure the smooth running of the premises. The IOC determines the Management Fees and these are payable on a monthly basis. 2. Government Rates The Government rates are approximately 5% of the estimated annual rental and are payable on a quarterly basis. They are determined by the Government with due adjustments to reflect any differences in size, location, facilities, standards of finish and management. 3. Government Rent The Government Rent is approximately 3% of the rateable value of the property and is payable on an annual basis. The Government rents are determined by the Government for the lease of the Government land on which the premises stand. All privately owned land in Hong Kong is normally held by the Government. 4. Property Tax A Property Tax is payable if the property is rented to a Tenant. The annual amount payable is 15% of the annual rental. The following deductions can be applied:

Whilst not totally necessary, some owners appoint an accountant whose annual charges amount to between approximately HK$10,000 to HK$15,000 per year. If you buy in a company name it is advisable, and an annual Business Registration Fee currently set at HK$2,250 will also be payable. 6. Insurance If the property is purchased with a mortgage, it is mandatory to have an insurance policy in place. The Mortgage Bank will advise you of their particular insurance packages. 7. Utilities These vary, but for a 1,500s.f. - 2,500s.f. apartment, please see below the approximate costs. These are typically paid by the Tenant/occupant Gas - HK$100-400 per month Water - HK$100-200 per month Electricity - HK$1,600-4,000 per month (air-conditioning usage can change this dramatically) Telephone / Internet - HK$500 per month (depending on your package) |